VTI: "Total Market" or Totally Overhyped?

So, VTI, huh? Vanguard's "Total Stock Market" ETF. Let's be real, the name itself is corporate marketing at its finest. "Total"? Give me a break. It holds, what, 3,488 stocks? Out of how many actually exist? It's like calling a pizza with pepperoni and mushrooms a "total food experience."

They’re pushing this narrative that it's the ultimate way to "stay aligned with the broader U.S. market." Aligned? More like tethered to the same sinking ship. And don't even get me started on the TipRanks Black Friday sale they’re hawking alongside it. "Invest with confidence"? Confidence based on what, exactly? Their "data-backed insights"? Sounds like fancy algorithms trying to predict the future, which, last time I checked, nobody can actually do.

The "Diversification" Delusion

The big selling point is always "diversification." Spread your eggs across the whole damn basket, right? But look at VTI's top holdings: Nvidia (NVDA), Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), Broadcom (AVGO). Sound familiar? It's basically the same tech giants that dominate every other index fund. So much for escaping the tech bubble.

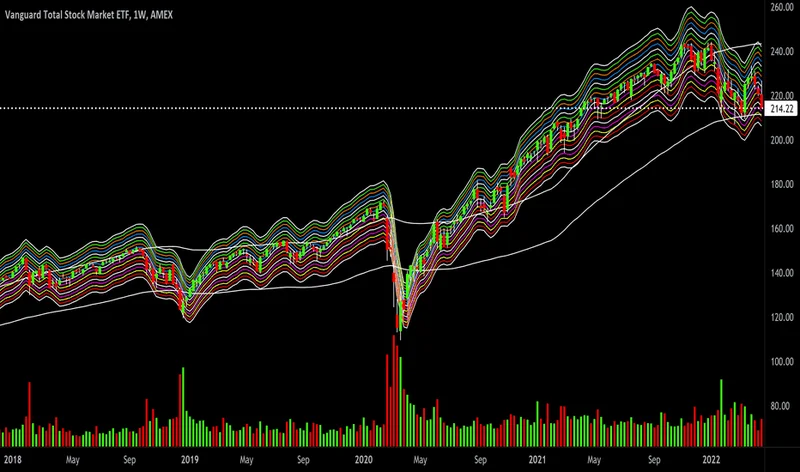

According to TipRanks, VTI has a "Neutral" rating based on the overall summary and a "Sell" rating based on the moving average consensus. Contradictory much? And it's trading below its 50-day exponential moving average, signaling a "Sell" signal. But hey, don't worry, analysts have an average price target that implies a 21.3% upside. Analysts also thought Theranos was going to revolutionize healthcare, so…

Offcourse, the real kicker is this: VTI’s Smart Score is seven, implying that this ETF is likely to perform in line with the broader market. In other words, it's average. Utterly, mind-numbingly average. Which begs the question: why bother? Why pay Vanguard their (admittedly tiny) expense ratio to get the same returns as everyone else?

Caterpillar Kicking Ass and Taking Names

Meanwhile, I stumbled across another article talking about how Caterpillar (CAT) is crushing VTI and VOO this year. Caterpillar? The heavy machinery company? Up over 56% year-to-date? What the hell is going on? These Dow Stocks Have Crushed the VOO and VTI in 2025—Here’s Where They’re Headed Next

Apparently, Wall Street analysts are all hopped up on Caterpillar's "upbeat targets" and "digital technologies." Digital technologies? Are we talking about tractors with touchscreens now? I don't get it. Maybe I'm missing something. Maybe I should be loading up on CAT stock and ditching this "total market" nonsense.

And Goldman Sachs (GS) is up over 36% year-to-date. Goldman Sachs! The poster child for Wall Street greed and corruption is outperforming the "total market." The world has gone completely insane.

I mean, let's be real, VTI is fine for what it is. A low-cost, passively managed ETF that tracks the entire U.S. stock market. But it's not some magical investment vehicle that's going to make you rich. It's not going to protect you from market crashes. And it's definitely not "total." It's just… there. Existing. Like elevator music.

So, What's the Real Story?

It's just another way for Vanguard to rake in fees while pretending to democratize finance. The "total market" is a lie. Diversification is a myth. And Wall Street is still run by a bunch of clowns.